The effects of the child tax credit will be extended through 2022. As a result, it is important to be aware of how the Child Tax credit affects you and your childcare this year.

Child Tax Credit

The child tax credit is a refundable tax for families and individuals with qualifying children. It was a major credit introduced last year to help parents with their childcare needs. For parents, that means an extra $250-300 monthly payments per child for parents that earn up to $150,000. The current legislation makes this tax credit permanently refundable. Furthermore, there is are talk about extending this policy to the future as well. However, the most important thing to know is how this tax credit affects your childcare.

Childcare

When it comes to the childcare industry, this tax credit will benefit parents, daycares, and childcare employees. The amount that parents pay for childcare will now be capped. The credit ensures that parents do not pay over 7% of their household income on childcare. This will ease the burden on many families who struggle to pay for childcare. The funding from the credit can be used on daycare because children 5 and under qualify you. However, this policy does not benefit just families. The wages of childcare workers will be increased as well.

Pre-School

The established plan for the child tax credit includes state funding to start and grow universal pre-kindergarten for 3 to 4-year-old children. As a result, states will begin rolling out programs for high-need and low-income areas that need childcare. Eventually, these state-funded programs will expand to other areas.

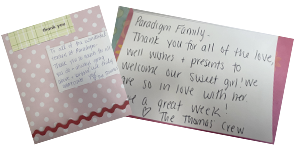

Enroll with Paradigm

While the effects of the child tax credit will change a few things, Paradigm will is dedicated to its mission statement. At Paradigm, we want to make lifelong learners that will become creative students with a strong heart and mind. Our programs are made to ensure your child’s natural talents and skills are nurtured by our caring staff members. If you have any questions about the child tax credit’s effect on childcare, contact us with your questions.